Trade credit insurance provides cover for businesses in the event of a customer becoming insolvent or failing to pay its trade credit debts. The credit insurer will monitor each of a policyholder’s insured customers, assigning them each a credit limit, which is the maximum amount covered in the event of an insolvency or non-payment.

Navigating Trade to

Protect Grow Secure Support Your Business

Experts in Safeguarding Your Financial Future

Welcome to Golding McEvoy Risk Consultants (GMRC)

Discover how credit insurance can help your business thrive.

Protect against the disastrous effects of bad debt.

We aim to improve the customer experience within the credit insurance broking market and to provide the very highest quality service to all of our clients.

With over 60 years combined experience in dealing with both direct to insurer clients, and brokered clients, we understand that all clients want the same things; a speedy response, great service, and the best advice.

At GMRC we are committed to providing our best service levels to all of our customers irrespective of their of spend, and we believe that everyone should be treated the same,

We aim to improve the customer experience within the credit insurance broking market and to provide the very highest quality service to all of our clients.

With over 60 years combined experience in dealing with both direct to insurer clients, and brokered clients, we understand that all clients want the same things; a speedy response, great service, and the best advice.

At GMRC we will not offer different levels of service to our clients depending on their spend.

We are committed to providing our best service levels to all of our customers, and we believe that everyone should be treated the same.

Why credit insure?

It gives businesses the confidence to extend credit to new customers and improves access to funding, often at more competitive rates. Not only this, but insurers can help to reduce the risk of financial loss through credit management support.

How is it priced?

The cost of a credit insurance policy is typically a small percentage of insurable sales. The price can depend on several variables starting with the turnover of the business. This is further influenced by additional factors such as the trading and loss history of the company, the trade sector and the customer base.

Just some of the

many benefits

of credit insurance

Growth

Expand safely and confidently with new customers, both domestic and abroad.

Speed

Be more efficient by helping you make the right decisions quickly.

Protection

It's there to replace money lost through bad debt as quickly as possible.

Funding

Negotiate better terms with your bank and other funders.

Peace of mind

Allows you to focus on other areas of your business knowing your invoices are protected.

Why use us?

The best cover at the best price.

We negotiate better terms.

We provide additional support.

The cost of our service is NOT passed on to you.

Our clients say

Meet our team

During this time Christine has managed a mixture of both direct and brokered clients. In her career at Coface she has been recognised as Account Manager of the year twice.

Her skills include being able to manage the entire customer journey from inception to renewal, as well as being able to manage issues with claims, collections and negotiate with underwriters on challenging credit limits. Most importantly Christine has the ability to concisely explain everything in such a way that customers feel at ease and comfortable in their obligations.

Her role within the business is to manage the client portfolio and grow the book via customer referrals and introductions.

With a proven sales record in the industry, his last role was Head of Direct Sales for one of the largest Credit Insurers in the world, Coface. In his six years there Dave achieved the accolade of top sales person in Western Europe twice and in the UK four times.

He is skilled at being able to ask the right questions, enabling him to really understand a client's needs and then working with the insurers to meet them. In addition to this Dave is extremely tenacious. In short if there’s a way to get a limit or policy written he will find it.

Most of his time is spent growing the client base through finance introductions, client referrals and networking. However, Dave is also responsible for managing a portfolio of clients and maintaining the highest levels of customer satisfaction and retention.

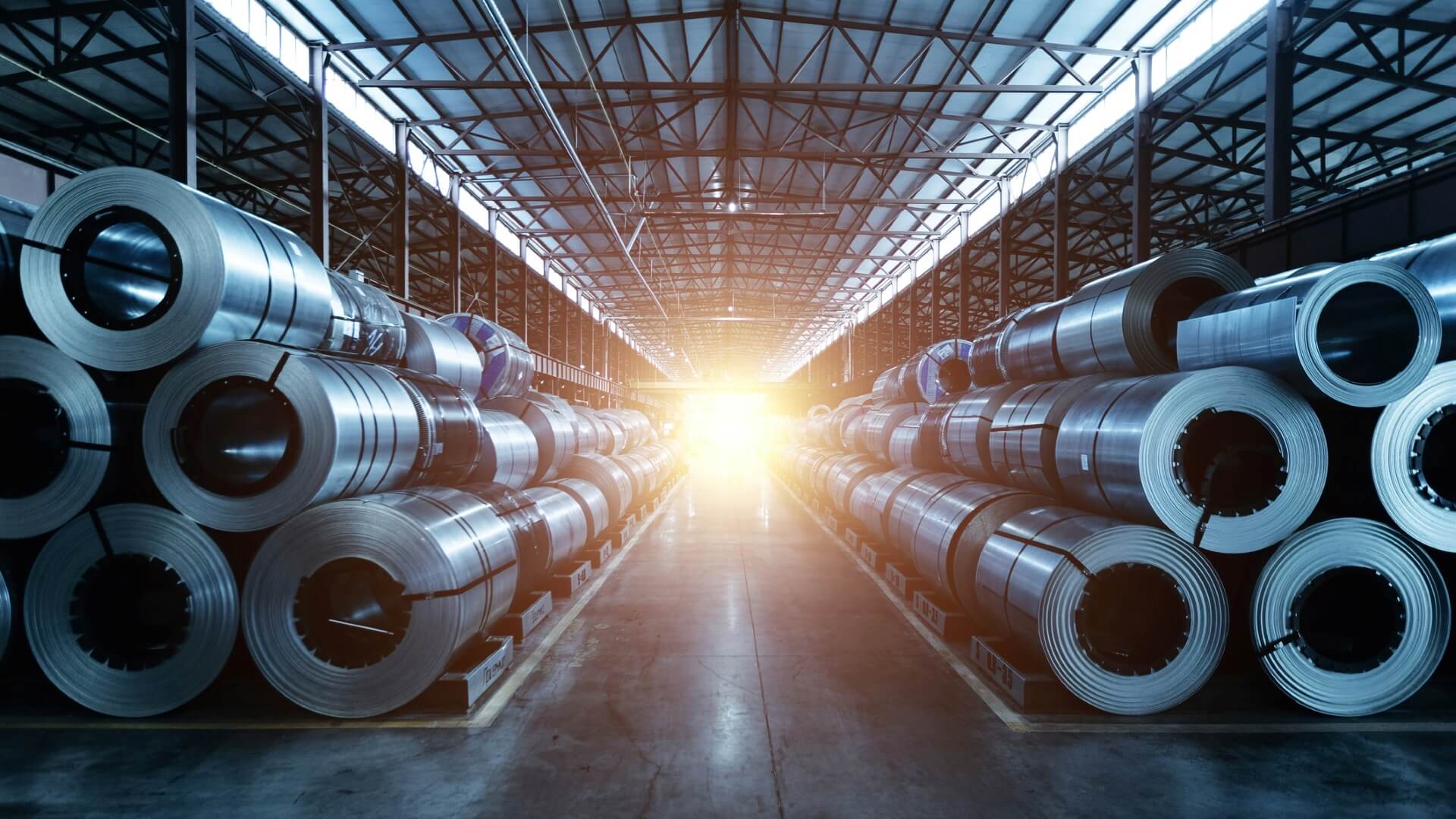

She is responsible for managing a client base across all sectors, including construction, retail, hospitality, food and drink, manufacturing and metals.

She has a passion for delivering a bespoke personal service, specifically targeted to each individual client; she second guesses their needs and provides effective solutions which fit seamlessly alongside their normal credit management processes securing strong and long-lasting relationships.

Emma loves the coast and a cracking sunset. She also enjoys watching rugby and supports the Exeter Chiefs.

Kelly is an Account Executive with her own portfolio of renewals, she assists the team where needed and enjoys interacting with clients and insurers. She helps throughout the client’s credit journey assisting with credit limits, collections, claims, and all other queries.

In her spare time Kelly can be found either walking along the beach with her two dogs or spending time with family and friends.

Latest news

Our chosen charity partner

A charity personally close to our hearts, we are delighted to be supporting the magnificent work Dogs for Autism does for the autistic community.

Autism assistance dogs support people in a variety of ways but are there to empower people to realise their individual potential and gain independence, in just the same way as a guide dog might for a blind person. Dogs for Autism aims to become for the autistic community what Guide Dogs are for the visually impaired.